Explore web search results related to this domain and discover relevant information.

Oil prices slipped $1 per barrel on Monday in volatile trading after reports that Iran is seeking an end to hostilities with Israel, raising the possibility of a truce and easing fears of a disruption to crude supplies from the region.

Exclusive news, data and analytics for financial market professionalsLearn more aboutRefinitiv · My News · Register · By Nicole JaoJune 16, 20257:04 PM UTCUpdated June 16, 2025 · Summary · Brent, WTI drop as reports suggest Iran seeking de-escalation · Iran asked Arab neighbors to press US president for Israeli ceasefire · Key oil export infrastructure spared so far in worsening Israel-Iran conflict · NEW YORK, June 16 (Reuters) - Oil prices slipped $1 per barrel on Monday in volatile trading after reports that Iran is seeking an end to hostilities with Israel, raising the possibility of a truce and easing fears of a disruption to crude supplies from the region."When you're in that state, the market is especially vulnerable to sharp liquidations," Johnston added.Brent crude futures settled $1, or 1.35%, lower to $73.23 a barrel. U.S. West Texas Intermediate crude futures fell $1.21, or 1.66%, to $71.77 per barrel.About a fifth of the world's total oil consumption, or some 18 to 19 million barrels per day of oil, condensate and fuel, passes through the strait.

How to Calculate Market Price Per Share of Common Stock. Market price per share of common stock is a useful analytical tool when determining if an investment in a company is worthwhile. After calculating the market price per share, compare it to the price

For example, if a firm has $200 million in equity after deducting the value of preferred stock, and 10 million shares outstanding, the book value works out to $20 per share. Market price is not tied to book value, and is often very different.The P/E ratio is a widely used measure calculated by dividing the market price on a given date by the earnings per share for the accounting period. To estimate the market price for the date, look in the company's annual report for the accounting period for the P/E ratio and earnings per share.In other words, this is the price you would expect to pay per share if all other factors were equal. A number of financial ratios use the market price per share of common stock.The price to book value ratio tells you how much equity you acquire for each dollar invested. P/BV is calculated by dividing the market price by the book value of common stock. ... For example, a stock with a price of $100 per share and a $50 book value has a P/BV of 2.

The global market for PERS) estimated at USD 9.38 Billion in the year 2023, is expected to reach a revised size of USD 17.39 Billion by 2032, growing at a CAGR of 7.1% over the forecast period 2024-2032.

The mobility factor added by the mobile PERS or mPERS is the primary driver of its growth in the global Personal Emergency Response System Market. the option provided by such PERS to leave patients or the wanted to leave at the home without losing the protective shield PERS device offers is invaluable.Such Increased peace of mind at home and outside of the home provided by remote PERS technologies through mPERS is expected to boost the growth of this segment in the upcoming years. North America Dominates the Global Market of Personal Emergency Response System (PERS) And It Is Also Expected to Dominate the Market Over the Forecast Period.Asia-Pacific is also expected to show a healthy growth rate in the market due to the increasing geriatric population and also due to implementation of home-based health programs. The COVID-19 pandemic has had a favorable impact on the application of Personal Emergency Response Systems owing to the growing demand for personal health monitoring systems across nursing homes and also by home-based users.For instance, Overall, 31% of cases, 45% of hospitalizations, 53% of ICU admissions, and 80% of deaths associated with COVID-19 were among adults aged greater than 65 years with the highest percentage of severe outcomes among persons that were aged more than 85 years. This hospitalisation rate especially among adults led to the development of the market for PERS during the pandemic.

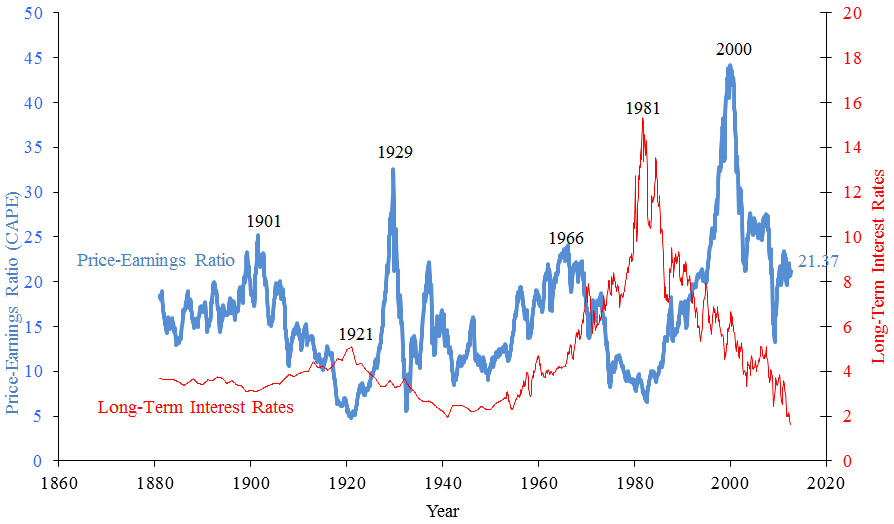

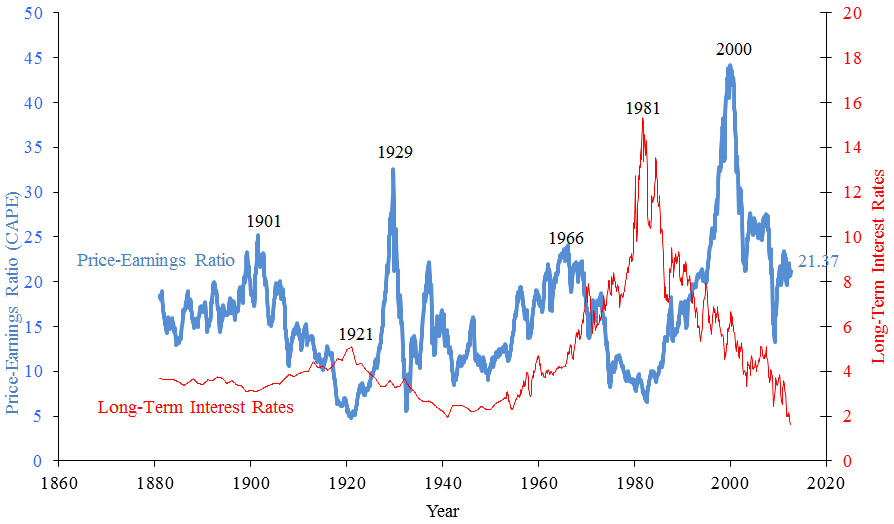

This suggests that the market is Strongly Overvalued. P/E ratios can only go so high. To justify a P/E ratio that is consistently above its own historic average for long periods of time, the US stock market must not only continue to grow, but would need to continue to grow at a continuously ...

This suggests that the market is Strongly Overvalued. P/E ratios can only go so high. To justify a P/E ratio that is consistently above its own historic average for long periods of time, the US stock market must not only continue to grow, but would need to continue to grow at a continuously increasing rate.Member Dashboard: Access a dashboard page summarizing each model and aggregate market value status. Correlations: Members can view detailed charts and metrics about the historical correlation that each valuation model has with subsequent S&P500 performance, over investment horizons from 1-month to 10-years.The same analysis can be done to the entire stock market. By adding up the price of every share in the S&P500, and comparing that to the sum of all earnings-per-share generated by those companies, you can easily calculate the P/E ratio of the US stock market.Most people are familiar with the price to earnings ratio, but the CAPE ratio (aka P/E10) actually provides better insight for long-term analysis. Here are the charts...

The market price per share of stock, or share price, is the most recent price that a stock has traded for. Learn about the forces that influence it.

Book Value per Share ... The market price per share of stock, or the "share price," is the most recent price that a stock has traded for. It's a function of market forces, occurring when the price a buyer is willing to pay for a stock meets the price a seller is willing to accept for a stock.When a trader places a market order to buy or sell a stock, it will execute at the market price. Unlike the book value per share, the market price per share has no specific relation to the value of the company's assets or any other balance sheet information.Since many casual investors do their trading through a brokerage app or website, it's easy to lose sight of the fact that each order you tap into your app is actually a real trade with another person. Digital tools have streamlined the process, but traders still need to find a partner to execute the order—a seller needs to find a buyer, and a buyer needs to find a seller. In technical terms, a seller offers an "ask" price at which they're willing to sell, and the buyer offers a "bid" price at which they're willing to buy. When the bid and ask prices meet, it creates a market price, and the trade is executed.A common mistake among beginning investors is to compare the market price per share between two companies. When Company ABC trades for $10 per share and Company XYZ trades for $1 per share, it may initially seem like Company ABC is more valuable, but that isn't what stock prices tell you.

Market value per share is the price at which a share of company stock can be acquired in the marketplace, such as on a stock exchange.

Market value per share is the price at which a share of company stock can be acquired in the marketplace, such as on a stock exchange. This price varies throughout the day, based on the level of demand for the stock. The price will rise when more investors want to buy it than are willing to sell, while the price will decline in the reverse situation.As an example of market value per share, a recent stock price for Microsoft Corporation was $400. This means that if an investor wants to buy one share of Microsoft, they would pay $400 at the current market price.Investor perceptions of the future prospects of the issuing entity's industry, and of the economy as a whole ... There are several differences between market value per share and book value per share, which are as follows:Derivation of value. The main difference is that market value per share is driven entirely by demand for a company’s shares, while book value per share is a firm’s net assets, divided by the number of shares outstanding.

The Indian stock market came back decisively after it saw a slump on Thursday. NSE Nifty regained 18,000 levels surging 229 points whereas BSE Sensex shot up 767 points.

According to industry experts, the current stock market pattern signals chances of an upside breakout. Here are stocks that investors should watch out for today, as per Moneycontrol.PB Fintech: The operator of Policybazaar will make a debut on the BSE and NSE on November 15. The final issue price has been fixed at Rs 980 per share.Academy To Make It Mandatory For Films To Mention AI Usage After The Brutalist, Emilia Pérez Controversies: ReportHad Permission To Busk: Ed Sheeran Clarifies After Bengaluru Police Stops His Street Performance Midway

The main stock market index of United States, the US500, rose to 6503 points on September 9, 2025, gaining 0.12% from the previous session. Over the past month, the index has climbed 2.03% and is up 18.33% compared to the same time last year, according to trading on a contract for difference ...

The main stock market index of United States, the US500, rose to 6503 points on September 9, 2025, gaining 0.12% from the previous session. Over the past month, the index has climbed 2.03% and is up 18.33% compared to the same time last year, according to trading on a contract for difference (CFD) that tracks this benchmark index from United States.

Cantaloupe shareholders will receive $11.20 per share in cash, a 34% premium to the unaffected stock price on May 30. 365 Retail Markets is a portfolio company of Providence Equity Partners. The transaction, unanimously approved by Cantaloupe’s board, is expected to close in the second half ...

Cantaloupe (CTLP) announced it has entered into a definitive agreement to be acquired by 365 Retail Markets in an all-cash transaction with an equity value of approximately $848M. Cantaloupe shareholders will receive $11.20 per share in cash, a 34% premium to the unaffected stock price on May 30.Published first on TheFly – the ultimate source for real-time, market-moving breaking financial news. Try Now>> ... Cantaloupe’s Strong Financial Performance and Growth Prospects Earn Buy Rating from Gary Prestopino365 Retail Markets is a portfolio company of Providence Equity Partners. The transaction, unanimously approved by Cantaloupe’s board, is expected to close in the second half of 2025, subject to shareholder and regulatory approvals. Cantaloupe will become a privately-held company upon completion. Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

The price/earnings ratio (PER) is the most widely used method for determining whether shares are "correctly" valued in relation to one another. But the PER does not in itself indicate whether the share is a bargain. The PER depends on the market's perception of the risk and future growth in ...

The price/earnings ratio (PER) is the most widely used method for determining whether shares are "correctly" valued in relation to one another. But the PER does not in itself indicate whether the share is a bargain. The PER depends on the market's perception of the risk and future growth in earnings.The PER of a listed company's share is the result of the collective perception of the market as to how risky the company is and what its earnings growth prospects are in relation to that of other companies. Investors use the PER to compare their own perception of the risk and growth of a company against the market's collective perception of the risk and growth as reflected in the current PER.Since 1900, the average P/E ratio for the S&P 500 index has ranged from 4.78 in Dec 1920 to 44.20 in Dec 1999. However, except for some brief periods, during 1920–1990 the market P/E ratio was mostly between 10 and 20.The average P/E of the market varies in relation with, among other factors, expected growth of earnings, expected stability of earnings, expected inflation, and yields of competing investments. For example, when U.S. treasury bonds yield high returns, investors pay less for a given earnings per share and P/E's fall.The stock price can increase in one of two ways: either through improved earnings or through an improved multiple that the market assigns to those earnings. In turn, the primary drivers for multiples such as the P/E ratio is through higher and more sustained earnings growth rates. Consequently, managers have strong incentives to boost earnings per share, even in the short term, and/or improve long-term growth rates.

The global cider and perry market demand is anticipated to be valued at USD 92,413 million in 2023, forecast to grow at a CAGR of 3% to be valued at USD 1,24,713 million from 2023 to 2033. Growth is attributed to increasing consumer preferences for ready-to-prepare food.

Proper perry, on the other hand, is made only from proper perry pears. Cider and perry drink is the fastest growing market in the drink industry and has been considered by old and young of both genders to be the preferred draught and packaged drink.The market has now opened up to a broader consumer spectrum from quality-pursuing to value-seeking drinkers and is comprised of many well-known & high-quality brands producing drinks in many flavors. The demand for craft beers has also spilled over to Cider and perry increasing the premium offerings of the consumers.The consumers in these mature markets are seeking beer alternatives which represent a huge opportunity for Cider and perry drink. Market innovation mixed with product innovation is also boosting the overall market for Cider and perry.Other factors attributable to the high growth include an increase in the aging population, increasing purchasing power, and a rise in per capita health expenditure. Changing consumers’ lifestyles, coupled with increasing demand in the food and beverage sector, has augmented the global market demand.

This method of calculating market ... representation of the actual "size" of a market. The larger the Notional Value traded, the more risk that actually changed hands. By way of example, 100 shares of stock ABC at $362 per share is a much larger transaction than 100 shares ...

This method of calculating market share, as opposed to simply using the total number of shares that traded hands, can be a better representation of the actual "size" of a market. The larger the Notional Value traded, the more risk that actually changed hands. By way of example, 100 shares of stock ABC at $362 per share is a much larger transaction than 100 shares of stock XYZ at $2.20 a share.This bar chart shows U.S. Equities trading volume in terms of market share across exchange venues (market share is calculated as a percentage of total consolidated U.S. Equities volume, including off-exchange volume).The NBBO Quote Quality chart visualizes two key metrics used to measure market quality and contribution to price discovery: time at the inside (x-axis) and size when at the inside (y-axis). Specifically, these are measured as "Average Size at the Inside" and "Percentage of Time at the Inside".Percentage of Time at the Inside is the percentage of time that a market has both a best bid and best offer at the inside (NBBO) price.

It also doesn't consider other financial aspects like debt levels, cash flow, or the quality of earnings. The P/E ratio is one of many fundamental financial metrics for evaluating a company. It's calculated by dividing the current market price of a stock by its EPS.

Hence, it’s sometimes called the price multiple because it shows how much investors are willing to pay per dollar of earnings. If a company trades at a P/E multiple of 20x, investors are paying $20 for $1 of current earnings. The P/E ratio also helps investors determine a stock’s market value compared with the company’s earnings.In general, a high P/E suggests that investors expect higher earnings growth than those with a lower P/E. A low P/E can indicate that a company is undervalued or that a firm is doing exceptionally well relative to its past performance. When a company has no earnings or is posting losses, the P/E is expressed as N/A. Though it's possible to calculate a negative P/E, it's not common. The P/E ratio can also standardize the value of $1 of earnings throughout the stock market.A P/E ratio of 15 means that the company’s current market value equals 15 times its annual earnings. Put literally, if you were to hypothetically buy 100% of the company’s shares, it would take 15 years for you to earn back your initial investment through the company’s ongoing profits. However, that 15-year estimate would change if the company grows or its earnings fluctuate. The trailing P/E ratio uses earnings per share (EPS) from the past 12 months, reflecting historical performance.Forward P/E is often used to gauge investor sentiment about the company's growth prospects while trailing P/E provides a snapshot based on actual past performance. The P/E ratio has several limitations. It doesn't account for future earnings growth, can be influenced by accounting practices, and may not be comparable across different industries. It also doesn't consider other financial aspects like debt levels, cash flow, or the quality of earnings. The P/E ratio is one of many fundamental financial metrics for evaluating a company. It's calculated by dividing the current market price of a stock by its EPS.

:max_bytes(150000):strip_icc()/Price-to-EarningsRatio_final-23bff9e93e624fdea7eb34ec993ea8a9.png)

At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage rates that help you manage your financial life.

Personal Loans · Insurance · Mortgages · Mortgage Calculator · Taxes · Videos · Latest · Trending Stocks · Market Sunrise · Morning Brief · Opening Bid · All Shows · Stocks in Translation · Trader Talk · Financial Freestyle · ETF Report · FA Corner · Options Playbook ·Yahoo Finance anchor Josh Lipton tracks Wednesday's top moving stocks and biggest market stories in this Market Minute. The S&P 500 (^GSPC) and Nasdaq Composite (^IXIC) are getting a boost on Oracle's (ORCL) revenue forecast. Klarna (KLAR) has gone public, with shares priced at $52 each.The opening price values Klarna at $18 billion. Coty (COTY) was downgraded to Hold from Buy at Berenberg. The firm also lowered its price target for the stock to $505 from $650. Stay up to date on the latest market action, minute-by-minute, with Yahoo Finance's Market Minute.U.S. markets close in 1h 19m

U.S. Market

Daily market summary represents volume from all trading venues on which Nasdaq® Issues are traded. Access year-to-date data for free · Data Fields & Definitions · Nasdaq Trader Popular Sections: Performance Statistics · Email Sign-Up · © Copyright · Disclaimer ·

China's consumer prices fall more ... woes persist · CNBC Daily Open: Bet on the Fed — not firings — to support jobs growth · European shares rise ahead of key U.S. inflation data; Zara owner Inditex jumps 6% ... Here are Wednesday's biggest analyst calls: Nvidia, Oracle, Apple, Tesla, Nike, HP, Meta, Trade Desk... ... More investors want public and private assets in their portfolio. Now there's a benchmark to track... ... U.S. stocks bearing the brunt of trillions in market value losses ...

China's consumer prices fall more than expected in August as deflation woes persist · CNBC Daily Open: Bet on the Fed — not firings — to support jobs growth · European shares rise ahead of key U.S. inflation data; Zara owner Inditex jumps 6% ... Here are Wednesday's biggest analyst calls: Nvidia, Oracle, Apple, Tesla, Nike, HP, Meta, Trade Desk... ... More investors want public and private assets in their portfolio. Now there's a benchmark to track... ... U.S. stocks bearing the brunt of trillions in market value losses around the globeView up-to-date U.S. market and world market charts. Get the latest on world economy news and global markets in our Market Overview.U.S. Markets'It's shameful' that Japanese companies are reluctant to let go poor performers: Activist investor

Where the stock market will trade today based on Dow Jones Industrial Average, S&P 500 and Nasdaq-100 futures and implied open premarket values. Commodities, currencies and global indexes also shown.

U.S. Markets · Currencies · Cryptocurrency · Futures & Commodities · Bonds · Funds & ETFs · Business · Economy · Finance · Health & Science · Media · Real Estate · Energy · Climate · Transportation · Industrials · Retail · Wealth · Sports · Life · Small Business · Investing · Personal Finance ·

Michael P. Reinking, CFA - Sr. Market Strategist

Yesterday, was a mixed session for equity markets with most major indices closing around unchanged levels.Catch equity highlights and market-moving news.Analysis of monetary policy decisions and market reaction.We asked some of the most curious minds in life sciences and healthcare to share thoughts on their careers, the future of health and more. Each participant drew questions and shared their insights, knowledge and some personal fun facts that left us inspired about the future of health and wellness.

The beverage premix market is estimated to be valued at USD 76.4 billion in 2025 and is projected to reach USD 123.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

Top Key Players in Beverage Premix Market: Nestlé S.A., The Coca-Cola Company, PepsiCo, Inc., Starbucks Corporation, Keurig Dr Pepper Inc., Unilever PLC, Ajinomoto Co., Inc., Monster Beverage Corporation, Suntory Holdings Limited, Tata Consumer Products Limited, Kraft Heinz Company, Mondelēz International, Inc., Danone S.A., Associated British Foods plc, Kerry Group plc, Ito En, Ltd., Diageo plc, Bacardi Limited, Pernod Ricard, Red Bull GmbH, DSM-Firmenich AG, Givaudan SA, International Flavors & Fragrances Inc., Symrise AG, Archer Daniels Midland Company, Cargill, Incorporated, Ingredion Incorporated, Tate & Lyle PLC, Nitin's Premixes, Veebha Beverages Private LimitedThe powder form segment is anticipated to lead the market with a 45.6% revenue share in 2025. This form’s preference has been attributed to its long shelf life, ease of storage, and efficient packaging, making it suitable for both personal and institutional consumption.The demand is rising due to the busy lifestyles of consumers who prefer time-saving, high-quality, and customizable drink options. Innovations in flavor profiles and packaging are contributing to market growth. Challenges like maintaining taste consistency and addressing packaging concerns persist in the sector.Premixes allow for consistency in taste and convenience, which is a key factor in the market’s growth. Additionally, as more people are shifting towards personalized and specialty drinks such as gourmet coffee, fitness shakes, and energy drinks, beverage premixes offer a quick and affordable way to cater to these preferences.

The personal emergency response systems (PERS) market is expected to reach USD 4.76 bn in 2025 and grow at a CAGR of 5.3% to reach USD 7.20 bn by 2033.

Global PERS Market Size, Share, Trends & Growth Forecast Report By Type (Mobile Based, Landline Based, Standalone), End User (Home-Based Users, Senior Living Facilities, Assisted Living Facilities, Others) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033.The global market is anticipated to grow at a CAGR of 5.3% from 2025 to 2033 and be worth USD 7.20 billion by 2033 from USD 4.76 billion in 2025. Personal emergency response systems (PERS) are medical devices where individuals call for medical help during an emergency.However, these traditional systems are simplistic and do not help prevent and manage life. In addition, as the market for personal emergency response systems evolved from the securities market, maturity problems and extreme sales practices that do not bode well for long-term growth have also served as barriers to this market.As per the statistics provided by the World Health Organization (WHO), approximately 1.4 billion people will be over 60 years of age by 2030, which is also one person in every six people. The usage of PERS devices is more common among people aged as these provide security for the aged. The growing number of technologically well-advanced PERS devices entering the market is anticipated to boost the market's growth rate.

:max_bytes(150000):strip_icc()/Price-to-EarningsRatio_final-23bff9e93e624fdea7eb34ec993ea8a9.png)